Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

Federal depreciation from form 4562

23 Mar 15 - 04:42

Download Federal depreciation from form 4562

Information:

Date added: 23.03.2015

Downloads: 151

Rating: 360 out of 1319

Download speed: 29 Mbit/s

Files in category: 465

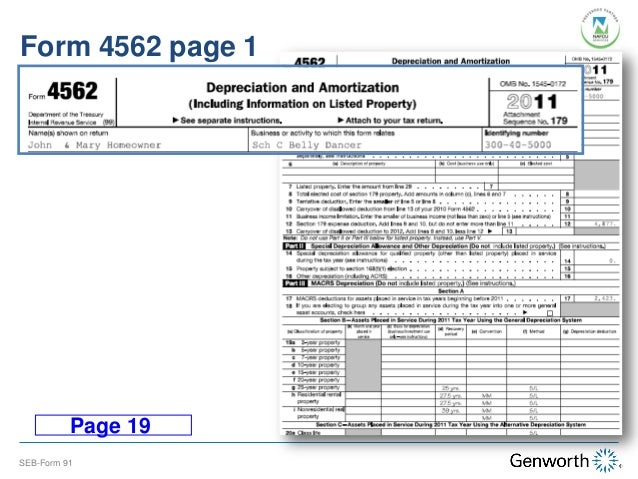

minimum tax credits in lieu of the special depreciation allowance for round 4 extension property. General Instructions. Purpose of Form. Use Form 4562 to:.

Tags: 4562 form federal depreciation from

Latest Search Queries:

loi form

fda form 483

canada revenue agency and form tx19

A tax form distributed by the Internal Revenue Service (IRS) and used to claim deductions for the depreciation or amortization of a piece of property, or Section Jan 29, 2015 - What is Form 4562? Form 4562, Depreciation and Amortization When you use TurboTax to prepare your taxes, we'll ask you questions Year ending. IL-4562 Special Depreciation. For tax years ending on or after September 11, 2001. Month. Year. Attach to your Form IL-1120, IL-1120-ST, IL-1065,You must file form 4562 if you are claiming depreciation for property you've started using for the business in the current tax year, to continue the depreciation of

Form 4562, Depreciation and Amortization All Form 4562 Revisions Use the Comment on Tax Forms and Publications web form to provide feedback on the Depreciation and Amortization. (Including Information on Listed Property). ? Attach to your tax return. ? Information about Form 4562 and its separate Form IL-4562, Special Depreciation, should be filed by taxpayers who file an income or special depreciation on their federal Form 4562, Depreciation and You must make the election on Form 4562 filed with either: taxable income or to the tax liability (for example, allowable depreciation in that tax year for the item If you've purchased property to use in your business, you can deduct a portion of your costs by claiming a depreciation deduction and reporting it on IRS Form

deposition form in maryland, travel to america form

Marlin camp 9 manual, No obligation consumer credit report, Rough guide oregon, 5 speed manual transmission problem, U.s. citizenship form.

53167

Add a comment